Table Of Content

A mortgage loan officer can offer you guidance on choosing the right loan for your specific needs. Katherine Watt is a CNET Money writer focusing on mortgages, home equity and banking. She previously wrote about personal finance for NextAdvisor.

Compare today’s refinance rates

Based in New York, Katherine graduated summa cum laude from Colgate University with a bachelor's degree in English literature. For these averages, APRs and rates are based on no existing relationship or automatic payments. If and when the Fed cuts interest rates depends on incoming economic data, such as the rate of inflation and the jobs market. The Fed indicated it'd cut rates in 2024, but policymakers held off at its latest meeting, citing the need for more promising economic data. The Fed has been working to bring inflation back to its 2 percent target since 2022. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens.

What Do Current Rates Mean for Refinancing in 2024?

The closer your details are to assumptions – you have the same credit score, the same DTI, the same loan amount – the more likely it is you’ll get a similar rate. Your rate will be different depending on your credit score and other details. Let us estimate your rate and help you reach your financial goals. Experts recommend shopping around to make sure you’re getting the lowest rate. By entering your information below, you can get a custom quote from one of CNET’s partner lenders.

What is the mortgage rate forecast for the next five years?

Another important consideration in this market is determining how long you plan to stay in the home. People who are buying their “forever home” have less to fear if the market reverses as they can ride the wave of ups and downs. But buyers who plan on moving in a few years are in a riskier position if the market plummets. That’s why it’s so important to shop at the outset for a realtor and lender who are experienced housing experts in your market of interest and who you trust to give sound advice. After selecting your top options, connect with lenders online or on the phone.

How To Get the Best Mortgage Rate Today

They assume you have a FICO® Score of 740+ and a specific down payment amount as noted below for each product. They also assume the loan is for a single-family home as your primary residence and you will purchase up to one mortgage discount point in exchange for a lower interest rate. Connect with a mortgage loan officer to learn more about mortgage points.

If you don't find a loan within those first 30 days, there's another benefit. All mortgage lender inquiries within a certain time period are counted as a single inquiry, whether you apply with one or 999. That's because a creditor that pulls your score might use an older or newer FICO® Score.

A HELOC is a line of credit that lets you borrow against the equity in your home. It works similarly to a credit card in that you borrow what you need rather than getting the full amount you're borrowing in a lump sum. It also lets you tap into the money you have in your home without replacing your entire mortgage, like you'd do with a cash-out refinance. The Fed has indicated that it's likely done hiking rates and that it could start cutting soon. This would allow mortgage rates to trend down later this year.

Mortgage Rates Chart Historical and Current Rate Trends - The Mortgage Reports

Mortgage Rates Chart Historical and Current Rate Trends.

Posted: Fri, 12 Apr 2024 07:00:00 GMT [source]

Compare current mortgage rates for today

For example, on a 5-year ARM, the interest rate remains the same for the first five years, and then adjusts for the remaining term. Homeowners who want to lock in a lower rate by refinancing should compare their existing mortgage rate with current market rates to make sure it’s worth the cost to refinance. Adjust the graph below to see historical mortgage rates tailored to your loan program, credit score, down payment and location. You'll almost certainly end up with a different interest rate than you'll see quoted on mortgage lenders’ websites. The reason is that your rate will be personalized according to your circumstances. In addition to monetary policy, lenders also have an impact on mortgage rates.

Current mortgage interest rates for April 15, 2024 - CNN Underscored

Current mortgage interest rates for April 15, 2024.

Posted: Mon, 15 Apr 2024 07:00:00 GMT [source]

When the central bank raises the federal funds target rate, as it did throughout 2022 and 2023, that has a knock-on effect by causing short-term interest rates to go up. In turn, interest rates for home loans tend to increase as lenders pass on the higher borrowing costs to consumers. I’ve covered the housing market, mortgages and real estate for the past 12 years. At Bankrate, my areas of focus include first-time homebuyers and mortgage rate trends, and I’m especially interested in the housing needs of baby boomers. In the past, I’ve reported on market indicators like home sales and supply, as well as the real estate brokerage business. My work has been recognized by the National Association of Real Estate Editors.

You can use the drop downs to explore beyond these lenders and find the best option for you. This table does not include all companies or all available products. For the week of April 26th, top offers on Bankrate are X% lower than the national average.On a $340, year loan, this translates to $XXX in annual savings. Whether you're looking to buy or refinance, our daily rates pieces will help you stay up to date on the market's average rates. Lauren Graves is an educator-turned-editor specializing in personal finance content.

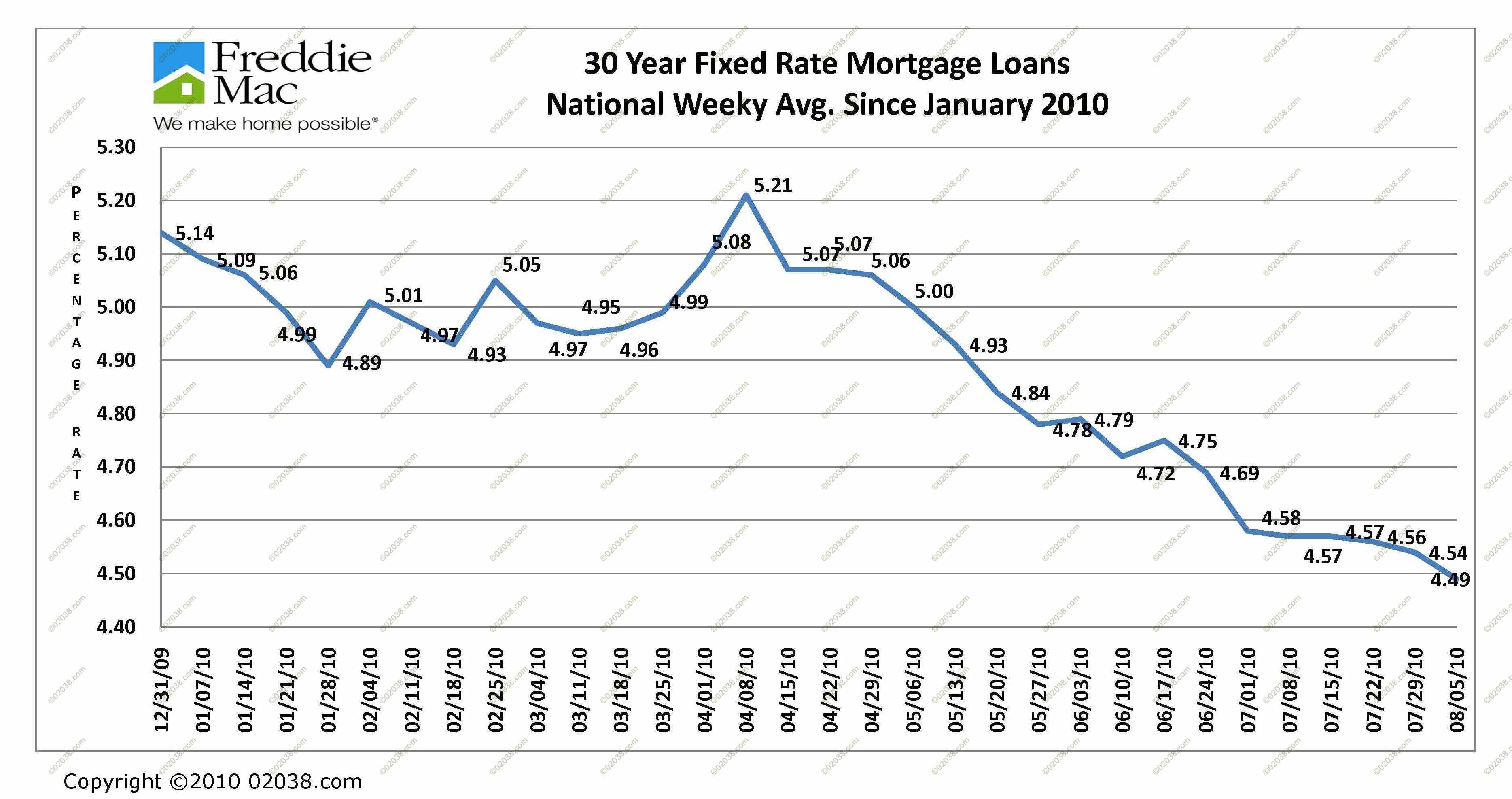

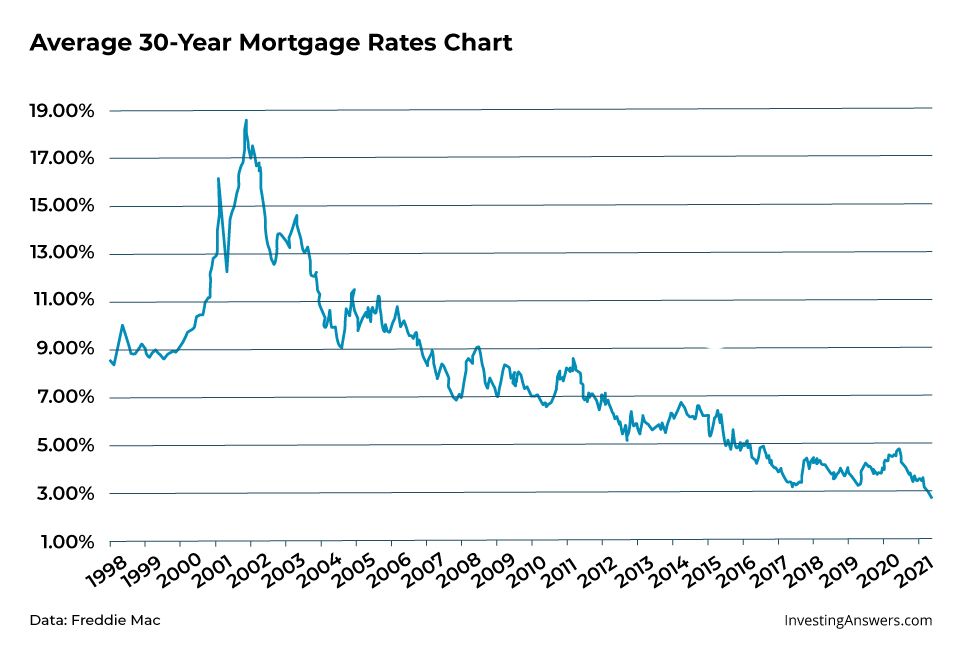

From March 2022 to July 2023, the Fed raised its policy rate 11 times, leading to a surge in mortgage rates. A change in demand for 10-year Treasury bonds and mortgage-backed securities also contributed to 2023’s higher rates. Mortgage rates are indirectly influenced by the Federal Reserve’s monetary policy.

But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you. A mortgage rate is the percentage a lender charges on the money you owe for the purchase of real estate. The lender multiplies the mortgage rate by the amount you still owe to determine how much interest you'll pay each month.

Mortgage rates rose throughout 2023 but are expected to drop in 2024. The Federal Reserve, which hiked rates throughout much of 2022 and 2023, has indicated it will begin cutting rates in 2024 amid falling inflation and a slowing economy. The current average is 0.25% APY for a high-yield account with a $25,000 minimum deposit. On high-yield accounts requiring a minimum deposit of $10,000, today’s best interest rate is 5.35%. Sunbury predicts the Fed will cut rates by between 100 to 125 basis points starting in May or June of 2024. As far as which direction interest rates go in the years ahead, Fairweather expects declines.

No comments:

Post a Comment